Engagement Letters for the Individual Tax Practitioner

Tighten language limiting your professional liability.

Professional liability insurance carriers and defense attorneys have always proclaimed that engagement letters are one of the first lines of defense in a malpractice cause of action against a CPA. After all, when drafted properly, engagement letters form the basis for an enforceable contract and should have caveats unique to the scope of service provided, the amount of risk inherent in the engagement, and the need to satisfy professional standards.

The authors have seen a resurgence in the popularity and use of engagement letters,coupled with a renewed interest in having engagement letters reviewed and critiqued by risk management professionals. The objective of this article is to develop an understanding of the fundamentals of engagement letters and to suggest provisions that will help minimize legal liability faced by CPAs.

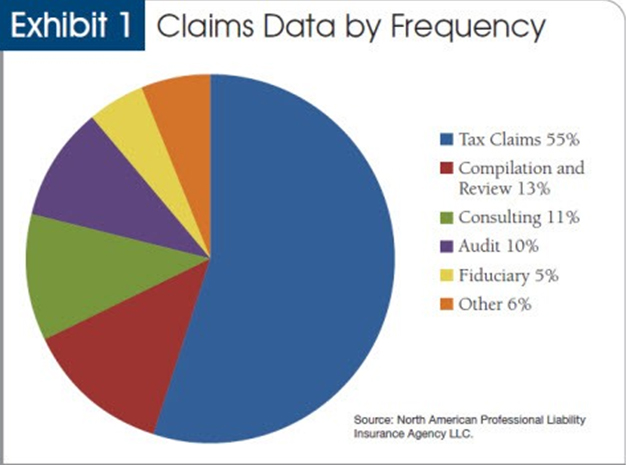

The majority of claims (by frequency) reported by leading CPA professional liability carriers (see Exhibit 1) stem from tax services, yet, according to the authors’ employer, the North American Professional Liability Insurance Agency LLC (NAPLIA), and their experience, individual tax engagements are where engagement letters are least used.

Faced with this historical pattern of claims behavior, it would behoove CPA firms to tighten their individual tax engagement letters and begin with the following fundamental objectives:

Address the letter to the appropriate parties in a formal introductory paragraph. Exclude any children of the client or other entities owned by the individual tax client and include the appropriate year or years that are being prepared.

Identify which returns are being prepared, and do not combine multiple returns. For example, do not include a gift tax return service with an individual tax service unless the proper disclaimer language for a gift tax return is included. The following language is highly recommended. It and most of the following passages are from or based on a full sample engagement letter available here:

We will prepare your [year] joint federal income tax return and income tax returns for the states of (collectively, the “returns”). This engagement pertains only to the [year] tax year, and our responsibilities do not include preparation of any other tax returns that may be due to any taxing authority.

Due to the increased focus by many state taxing authorities on applying the Nexus rules to a particular tax payer and the resulting potential of malpractice, the following clause is also highly recommended:

Our services are not intended to determine whether you have filing requirements in other taxing jurisdictions than the one(s) you have informed us of. Our firm is available under the terms of a separate engagement letter to provide a Nexus study that will enable us to determine whether any other state tax filings are required.

While many tax organizers and the affirmations made on Schedule B, Interest and Ordinary Dividends, of Form 1040,

U.S. Individual Income Tax Return, help in defending claims that allege a failure to advise a client with respect to foreign bank account returns (FinCEN Form 114 (formerly TD F 90-22.1), Report of Foreign Bank and Financial Accounts (FBAR)), the optimal defense is strong and clear engagement letter language that is signed by the client(s). This area presents unique risks, as both civil and criminal liability can arise for the CPA. With the IRS placing much focus in this area, practitioners should address foreign bank accounts in the letter itself.

A jurisdiction clause such as the one below is critical in an engagement letter for out-of-state clients. If such a clause is not used, the following could occur:

Example. Firm A, which has its only office in New York State, prepares a tax return for a New Jersey resident client (Client B). Client B sues Firm A, alleging improper advice regarding the real estate professional rules and regulations. The lawsuit is commenced and filed in Hudson County, New Jersey, where Client B resides. New Jersey has a six-year statute of limitation for accountants’ negligence, while New York has a three-year statute. By not having insisted on New York state jurisdiction, the firm has extended the statute by at least three years. Below is a sample jurisdiction clause.

Notwithstanding anything contained herein, both accountant and client agree that regardless of where the client is domiciled and regardless of where this Agreement is physically signed, this Agreement shall have been deemed to have been entered into an Accountant’s office located in [Specific County], [Specific State], USA, and [Specific County], [Specific State], USA, shall be the exclusive jurisdiction for resolving disputes related to this Agreement. This Agreement shall be interpreted and governed in accordance with the Laws of [State].

Payment terms, retainers, late charges, additional fees, and stop-work provisions for nonpayment need to be addressed. Clarity and diligence must be adhered to in this section, as many professional liability lawsuits, state board ethical complaints, and loss of clients have resulted from misunderstanding these provisions. Too often, only a phrase such as the following is used in a standard letter:

Our fee for services will be at our standard billing rates for personnel assigned to this engagement [or fixed fees to cover other than hourly fee arrangements]. Payment is expected when our services are complete.

Eliminate confusion, loss of clients, and financial damages by considering the following enhancements to the typical, limited clause above:

- Delineate the payment terms.

- Stipulate that a retainer will be required and will be applied toward the final fee and that the retainer is not an estimate of the fee charged for services.

- Identify when payment is expected.

- Provide for a termination of services if the fee is not paid in full.

- Use an additional charge clause for services not originally contemplated.

- Include a provision for reimbursement for out-of-pocket expenses such as travel, special delivery, etc.

Shortcuts should be avoided, as this is one of the more common areas causing professional liability lawsuits. Further, CPAs should be paid timely for their work.

Due to the need to preserve data security and client confidentiality in this age of electronic communication, this exposure should be identified in the engagement letter. A clause to help minimize this exposure follows:

In connection with this engagement, we may communicate with you or others via email transmission. As emails can be intercepted and read, disclosed, or otherwise used or communicated by an unintended third party, or may not be delivered to each of the parties to whom they are directed and only to such parties, we cannot guarantee or warrant that emails from us will be properly delivered and read only by the addressee.

Therefore, we specifically disclaim and waive any liability or responsibility whatsoever for interception or unintentional disclosure of emails transmitted by us in connection with the performance of this engagement. In that regard, you agree that we shall have no liability for any loss or damage to any person or entity resulting from the use of email transmissions, including any consequential, incidental, direct, indirect, or special damages, such as loss of revenues or anticipated profits, or disclosure or communication of confidential or proprietary information.

The value of tax organizers in defending a CPA in a professional liability claim cannot be overstated; however, many practitioners complain that their clients do not complete the organizer and at times return it unopened. As a result, CPAs need to push back and have the client take responsibility for the data. Engagement letter language should establish this responsibility:

We will prepare the returns from information which you will furnish to us. It is your responsibility to provide all the information required for the preparation of complete and accurate returns. We will furnish you with questionnaires and/or worksheets as needed to guide you in gathering the necessary information. Your use of such forms will assist us in keeping our fee to a minimum. To the extent we render any accounting and/or bookkeeping assistance, it will be limited to those tasks we deem necessary for preparation of the returns,

Each firm has its own comfort level with respect to risk, and every client relationship varies. For this reason, many more areas should be explored for engagement letters than this article can address. (See “Engagement Letter Checklist,” below for other key issues engagement letters should address.)

Before using any engagement letter in their practice, CPAs should retain an attorney knowledgeable about the accounting industry, their practice, and the laws of any jurisdiction(s) within which they practice, to ensure the document’s maximum usefulness and compliance with applicable laws and professional standards.

Engagement letters are one of the first lines of defense in an accountant’s professional liability lawsuit. If drafted properly, they are immeasurably valuable in heading off claims and resolving client distractions.

Engagement Letter Checklist

The following checklist suggests additional considerations for engagement letters, return preparation, and administrative practices:

Exclusion clause. Because tax services can be broad, an exclusion clause that identifies what services will not be provided can be invaluable. For example, a payroll tax preparation engagement might exclude independent contractor classifications, labor regulations, ERISA (Employee Retirement Income Security Act) compliance, and the reasonableness of officers’compensation.

Deadline for submitting return information. Establishing a date by which the client must provide the firm information needed to prepare the return is essential.

Stop-work provisions. Although stop-work provisions are typically used for nonpayment of fees, CPAs should consider them for conflicts of interest and clients who provide tax information late, refuse to take the CPA’s advice, or act unethically.

Limitation on use of the returns. Clients may submit tax returns to third parties in lieu of a financial statement, for which potential liability can be addressed through a clause limiting returns’ use and distribution.

Tax position clauses. Many times, what the client thinks is acceptable will conflict with professional standards. Establish language stating that tax positions taken must satisfy professional standards.

Supporting documentation. Because an examination is always possible, remind clients of their responsibility to maintain adequate records to support the deductions claimed on the return. Include the proper length of time for which the records should be maintained.

Taxing authority examination. Representing a client in an examination may be more involved than the return preparation itself, for which many CPAs may not feel equipped. A representation should be covered by the terms of a separately signed engagement letter.

Outcome or results. The engagement letter is a contract and not a marketing device. Particularly with amended tax return and tax audit engagements, do not guarantee outcome or results.

Successor and assigns. To prevent having to ask clients to sign an additional engagement letter if the firm is acquired by another firm, include successor-and-assigns language.

Limitation of liability, consequential damage disclaimers, and limiting the period to commence a lawsuit. While these clauses are state-specific, their use should not be overlooked.

Alternative dispute resolution (ADR). Coupled with insurance policy benefits (possible reduced deductibles), ADR is one of the best lines of defense against CPA malpractice claims.

Indemnification and hold-harmless clauses. Third parties are not bound by engagement letters, and many professional liability claims result from third-party suits. Often, the CPA can be reimbursed for losses by implementing indemnification and hold-harmless clauses. A common indemnification is for time spent in providing testimony in tax investigations and inquiries.

Review of prior-year returns. State that you are responsible only for positions taken on the current-year return and not for those on returns for previous years prepared by another firm or preparer.

EXECUTIVE SUMMARY

Tax engagement letters are an important defense against a malpractice cause of action against a CPA tax adviser or preparer.

Letters should be individually tailored for the year, type of return of the engagement, and taxing jurisdiction(s). They should acknowledge that the client may have filing requirements in tax jurisdictions other than the one or ones identified to the CPA.

Another area engagement letters should address is foreign financial accounts, since the IRS has been increasing its enforcement efforts in this area. A tax organizer can also be useful, and letters can specifically encourage clients’ completing one.

Business considerations of the engagement should also be covered, such as payment terms,retainers,expenses, and additional fees. Firms may also wish to address risks of data security.

John F. Raspante (johnr@naplia.com) is director of risk management for the North American Professional Liability Insurance Agency (NAPLIA) in Framingham, Mass. StephenVono (stevev@naplia.com) is a founding owner of NAPLIA.